Digest 38. What’s the best combination of pay-for-performance plans?

Trying to boost employee performance, organizations typically use pay-for-performance (PFP) plans as part of their compensation systems. These plans are payments made to employees that vary based on individual or organizational performance.

Studies have shown that PFP plans have positive effects on employee and organizational performance, by operating via two mechanisms: the incentive mechanism and the sorting mechanism. The incentive mechanism refers to the impact of PFP plans on employee motivation which is heightened and results in better employee performance; while the sorting mechanism impacts the composition of the workforce. PFP plans influence the quality of those who apply for jobs and those who leave the organization (typically, PFP plans would aim to encourage under-performers not to apply or, on the opposite, leave the organization and over-achievers to stay with the company).

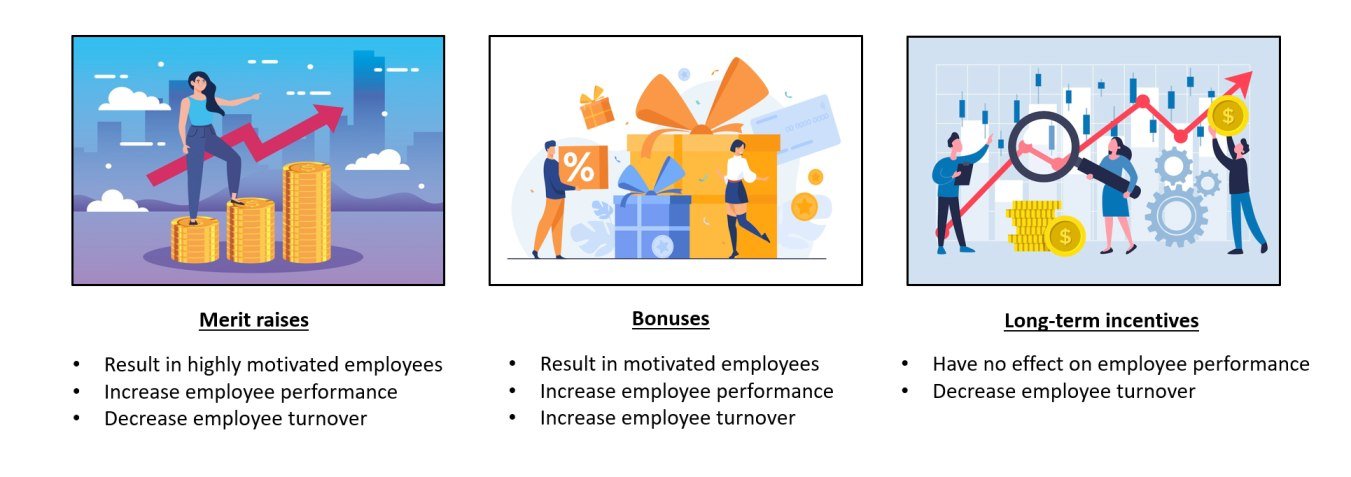

PFP plans differ based on the performance metric they consider (i.e., individual, team, or unit performance) and also the type of rewards/compensation they provide – which can span recognition, non-monetary awards, cash awards, permanent pay increase, or long-term incentives. Three of the most common PFP plans are: merit-pay, bonuses, and long-term incentives.

Merit pay is a permanent pay increase -that is, a pay raise- that is based on individual past performance. Merit pay increases the base pay and is received by the employee regardless of her future performance.

Bonus pay is a monetary reward given to the employee based on her individual performance but does not increase the base pay. This PFP plan is quite popular among organizations as it is paid once and does not increase the fixed labor costs.

Long-term incentives are rewards based on individual performance but also linked to a firm’s long-term growth and are paid in cash or stocks. The amount of the award is dependent on organizational performance.

Usually, organizations use multiple PFP plans simultaneously, thus it is important to explore how these plans together impact employee performance.

How does the combination of different pay-for-performance plans impact the performance/turnover of employees?

To address this question, Park and Sturman (2016) collected data from an American company that provides services to organizations operating in the global travel industry. Their sample consisted of 720 employees working with 88 supervisors from 17 locations in the USA. Analyzing the data, Park and Sturman found that, individually, each of the three PFP plans (i.e., merit pay, bonuses, and long-term incentives) increases employees’ future performance (incentive effect) and decreases employees’ turnover (sorting effect).

They also found that in having all three PFP plans simultaneously, merit pay has a positive incentive effect on individual performance. Bonuses also have positive incentive effect on individual performance, but this effect is smaller than the effect of merit pay. In other words, employees are more motivated by merit pay than bonuses when these PFP plans are awarded simultaneously. It was also found that in combining all three, long-term incentives have no effect on employee motivation nor performance in comparison to bonuses and merit pay, which are immediate payments while long-term incentives are not immediately liquid.

When it comes to turnover, Park and Sturman found that merit pay and long-term incentives decrease the turnover of high performers. Merit pay explicitly appreciates top performers by increasing the base pay and signaling they are valued by the organization. Long-term incentives, due to their non-immediacy, help retaining the high performers in the organization. On the other hand, bonuses, due to their immediacy, even increase employee turnover.

Organizational implications

To organizations that are pondering about the best pay-for-performance plan (or combination thereof), we recommend the following:

While the tendency is trying to reduce merit raises to reduce fixed costs, be aware that raises have larger effects on employee performance in comparison to both bonuses and long-term incentives. Moreover, merit pay is also the only plan that has both incentive and sorting effects, so it also reduces the turnover of high performers.

Bonuses would need to be larger to lead to higher employees’ performance; therefore, organizations need to make the cost-benefit decision on whether to have higher one-time costs (bonuses) or fixed labor costs (raises). To complicate the decision even more, in combination with other pay for performance plans, bonuses are shown to increase turnover.

Long-term incentives, while less effective than other plans to increase motivation and performance, are effective at increasing commitment and reducing turnover. Hence, they may be a valid option to consider when sorting effects are a priority (particularly in the war for talents) and when liquidity issues may prevent large investments in pay raises.

——

Reference: Park, S., & Sturman, M. C. (2016). Evaluating form and functionality of pay‐for‐performance plans: The relative incentive and sorting effects of merit pay, bonuses, and long‐term incentives. Human Resource Management, 55(4), 697–719. https://doi.org/10.1002/hrm